Fair Finance Pakistan’s latest study, ‘Pitfalls of Restoring Energy Security with Coal Power Plants in Pakistan,’ examines the adverse economic and environmental impacts of coal-fired power plants in Pakistan. Authored by senior economist and Professor of Economics at the Lahore University of Management Sciences (LUMS) Dr. Abid Burki, the report analyses Pakistan’s debt crises and its ability to repay energy loans, and recommends transitioning from fossil fuels to renewable sources of energy.

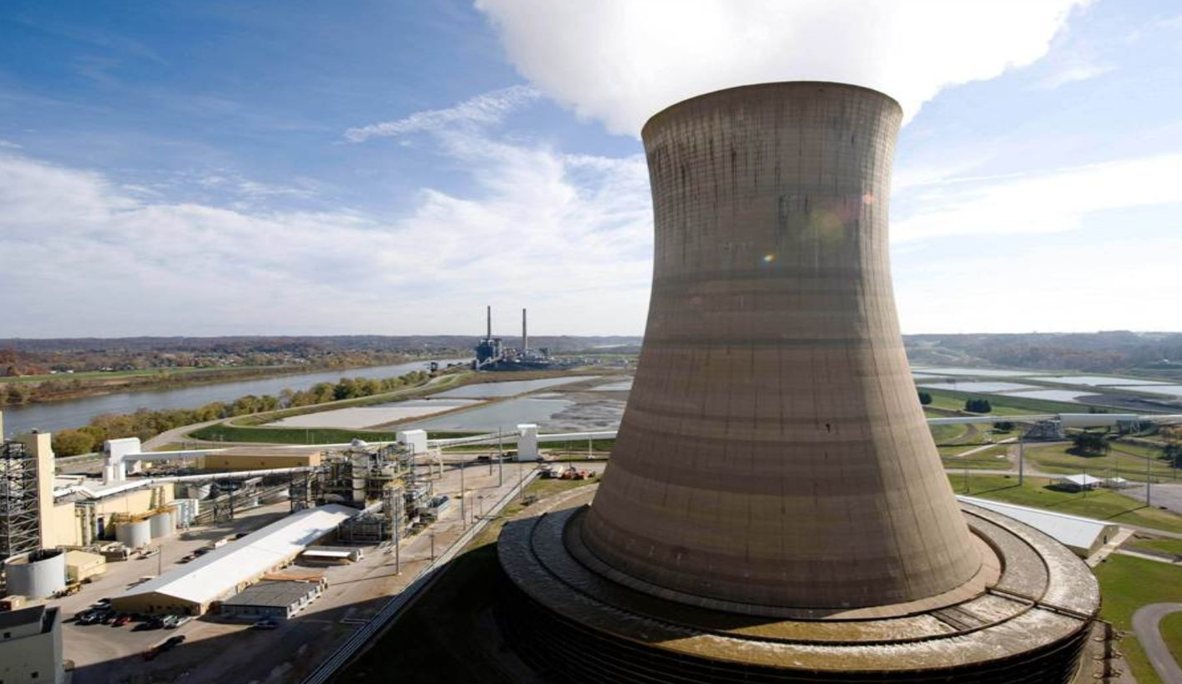

The study found that coal-fired power plants contribute 13% to the installed capacity of the power grid. Meanwhile, coal’s share in electricity generation is relatively high, as it has supplied more than 30% of the energy provided to the national grid since 2019. Pakistan currently has eight coal-fired power plants projected to generate 6930 MW of electricity, with 36 new coal power plants in the pipeline from 2032 to 2040, which, altogether, are expected to generate 23,760 MW of electricity. Clearly, there is high carbon-intensive lock-in within the national grid.

The study also highlights Pakistan’s history of electricity woes and power outages, and outlines why the bulk of external projects center on coal-fired power plants to lower the cost of electricity generation. The report makes a strong case that coal-fired power plants may add to Pakistan’s sovereign debt burden due to exchange rate fluctuations that may increase debt and affect the ability of Pakistan to repay loans.

During media briefings in Karachi and Lahore on June 24 and June 29, 2022, Fair Finance Pakistan Program Lead Mr. Asim Jaffry said, “Pakistan’s power shortages and resulting blackouts have reduced the country’s GDP by 2% for the past several years. Pakistan’s import-driven energy policy drains its foreign exchange reserves, exposes the economy to international energy price shocks, and puts it at risk of high inflation. Rising prices of imported fuel has a direct impact on common citizens because they are forced to pay higher electricity bills and are trapped in inequality.”

Mr. Asim added that rupee devaluation is contributing to the country’s inability to repay loans and issues with energy security. “In the past forty-four months, Pakistan’s currency has devalued by 48%, falling from PKR 123 per USD in January 2018 to PKR 182 per USD in April 2022 and Rs. 220 in June 2022. Devaluations put Pakistan in a difficult position for repayments and make Pakistan more vulnerable to energy insecurity, given the high proportion of power plants that use imported coal.”

In addition to financial risks, coal-fired power plants carry a multitude of environmental and health risks. Namely, coal-powered plants are likely to increase Pakistan’s greenhouse gas emissions, hampering its commitments to reduce carbon emissions, as per the Paris Agreement. Coal mining and processes involved in generating electricity from coal are water-intensive, thus posing an added threat to Pakistan’s water crisis. There is growing evidence that coal-fired power plants threaten local ecology and create health problems from associated air pollution within Pakistan. The case study recommends transitioning to renewables not only to protect Pakistan from a climate catastrophe, but also to become more cost-effective and ensure increased energy security for the country for years to come.

About Fair Finance Pakistan

Fair Finance Pakistan (FFP) is committed to ensure that financial institutions in Pakistan respect the social and environmental well-being of local communities, and integrate ESG (environmental, social, and governance) criteria in their business strategies. FFP is part of Fair Finance Asia – a network of over 100 Asian civil society organizations working towards ensuring that financial institutions’ funding decisions in the region respect the social and environmental well-being of local communities. Fair Finance Asia is a part of the global network Fair Finance International. For more information, please contact: Asim Jaffry, Program Lead, Fair Finance Pakistan at asim.jaffry@indusconsortium.pk